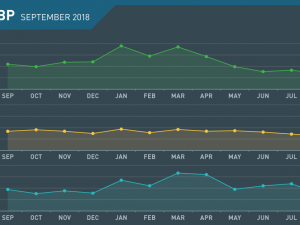

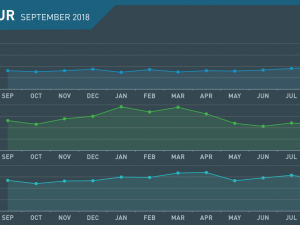

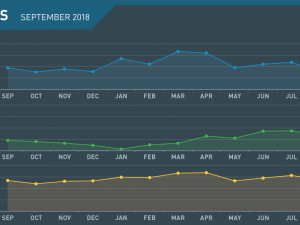

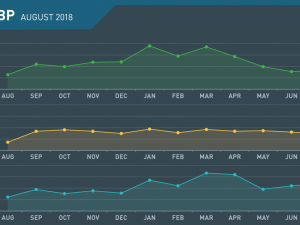

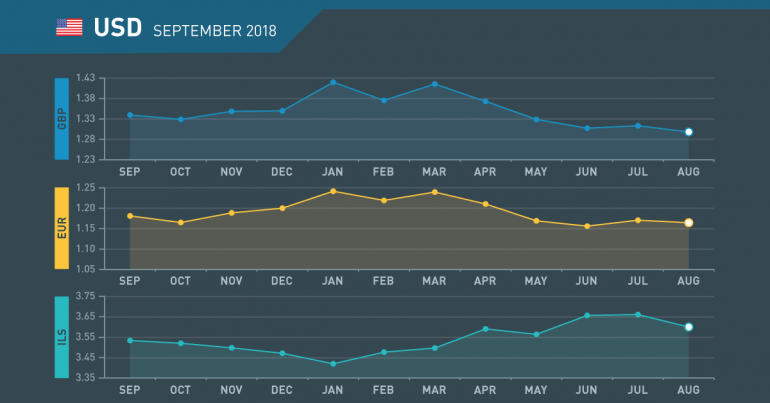

USD Monthly Review September 2018

August in review

Trump not thrilled with Fed

- Trump criticises rate hikes

- Powell confirms switch to reactive hikes

- Trade deficit widens

- Wages and jobs growth slowing

Tighter monetary policy upsets President

President Trump pronounced himself “less than thrilled” with recent monetary policy decisions by the FOMC despite being instigator of the policies that required the Fed to hike.

Powell turns reactive

In Jackson Hole, Fed Chairman announced that the time has come for a more reactive Fed. This was what was expected of him when he was elected and should lead to more transparency.

Trade back in focus

The U.S trade deficit grew by 6.3% MoM in July, raising the possibility of further tariffs on U.S. imports.

Economic positives fading

The “goldilocks” scenario which led to 4.2% growth in Q2 is fading with growth likely to be nearer 3% in Q3 with the outcome that the dollar may correct further.

September what to watch

Another hike?

- FOMC may hike again

- Trade war to return?

- Trump to face calls for impeachment

- Dollar correction to continue

Another hike in late September?

Despite Trump not “feeling it” the FOMC looks likely to hike rates again at its late September meeting, prior to an expected fall in growth that will keep rates on hold for a while thereafter.

No progress in talks may mean more tariffs

Trade talks between China and the U.S. yielded no progress so a further round of futile tariffs is likely, leading to tit-for-tat measures from Beijing.

Trump facing calls for impeachment

Following guilty verdicts against two of his former allies, President Trump faces further investigation possibly leading to his impeachment.

Dollar facing lack of positivity

Despite various drivers for the dollar, which led the dollar index to a high of 96.99, the positivity is fading and creating a correction which may lead to a downturn for the greenback.

September 2018 : Key Events

Tuesday

- ISM Manufacturing PMI

Thursday

- ADP Employment Change

- Crude Oil Inventories

- Unemployment Claims

Friday

- Average Hourly Earnings m/m

- Non-Farm Payrolls

- Unemployment Rate

Wednesday

- PPI m/m

Thursday

- Core CPI m/m

Friday

- Retail Sales m/m

- Industrial Production

Monday

- Empire State Manufacturing

Wednesday

- Building Permits

- Housing Starts

Thursday

- Phily Fed Manufacturing Index

- Existing Home Sales

Tuesday

- Consumer Confidence

Thursday

- Durable Goods Orders m/m

Friday

- Personal Spending m/m

- Chicago PMI