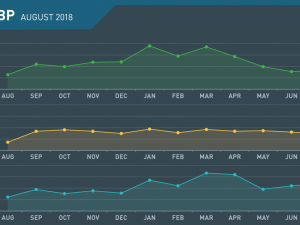

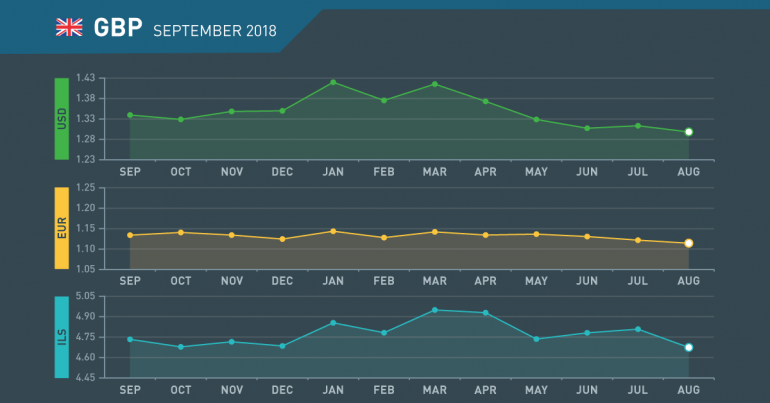

GBP Monthly Review September 2018

August in review

Hard Brexit becoming a reality?

- Hammond comments refuted by May

- Sterling falls against Euro

- Inflation rises for first time this year

- No deal Brexit fears grow

Hammond voices no deal Brexit concern

Chancellor Philip Hammond voiced fears GDP could fall by 10% in the event of a no deal Brexit. Theresa May later commented that a no deal Brexit “wouldn’t be the end of the world”, sending Sterling lower.

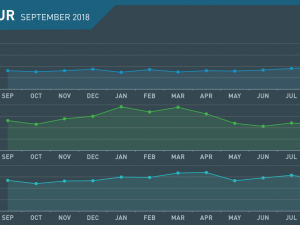

Sterling falling steadily versus Euro

Sterling lost ground steadily versus the single currency in August. Making a low of 1.0990, its lowest level in nearly a year. A sustained break of 1.10 leads many to fear a drop to parity.

Rise inflation confirms rate hike

Following the hike in rates by the BoE, inflation data showed that prices rose for the first time in a year. This, to a certain extent, justified the hike in rates.

Dire consequences of no deal Brexit growing

Following comments by Trade Minister, Liam Fox, and BoE Governor, Mark Carney, fears of a no deal Brexit are mounting as neither side displays any urgency.

September what to watch

May in Trouble

- Return of Parliament to lead to volatility

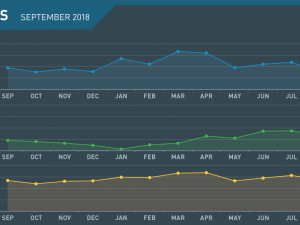

- Sterling set to test 1.25/1.08

- Johnson to launch challenge

- Brexit talks to reach crucial point

Parliament’s return to open Brexit wounds

The relative peace from Government infighting and political squabbling is set to end as Parliament returns from its summer recess on September 4th.

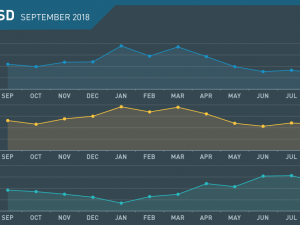

Sterling likely to fall as Brexit concerns weigh

Sterling’s relatively steady summer is likely to end as it comes under pressure from Brexit and faltering economic conditions.

May to face leadership challenge?

Ex-Foreign Secretary, Boris Johnson’s summer may have been spent plotting the downfall of his erstwhile boss and a leadership challenge may be forthcoming.

Brexit talks resume

Brexit talks resume in Brussels with the EU likely to “gently” reject Theresa May’s Chequers proposals. Despite being encouraged to continue to seek a solution this may be the catalyst for a hardening of the UK’s attitude.

September 2018 : Key Events

Monday

- Manufacturing PMI

Tuesday

- Construction PMI

Wednesday

- Services PMI

Monday

- GDP m/m

- Manufacturing Production m/m

- Industrial Production m/m

Wednesday

- Average Earnings

- Claimant Count Change

- Unemployment Rate

Thursday

- MPC Meeting & Rate decision

Tuesday

- CPI y/y

- PPI Input m/m

- RPI y/y

- PPI Output m/m

Thursday

- Retail Sales

Friday

- Public Sector Net Borrowing

Thursday

- GfK Consumer Confidence