MPC to inject a further £100 billion

Morning mid-market rates – The majors

5th November: Highlights

- Lockdown 2 to herald economic slowdown

- Trump doesn’t know when he’s beaten, in a bad way

- Eurozone slowly slipping back into recession

Bailey leaning towards negative rates?

Andrew Bailey, the Bank’s Governor is willing to be influenced by his colleagues on the Committee regarding taking official interest rates negative. While this is considered to be the nuclear option, Bailey does not see the continual printing of money as the answer either.

It appears that the pound is emerging from the protection it received as an EU member, even outside of monetary union, and is trading more like a currency that is driven by risk appetite and aversion.

This is likely to add to volatility going forward as Sterling becomes more reactive to trade issues and the wider global economy.

The prospects for a trade deal with the United States will be affected by the situation that is developing over the election.

Malcolm Rifkind who was Foreign Secretary under Margaret Thatcher appeared on TV yesterday and was asked how he felt the election result would affect any deal. He believes that a deal won’t be easy to achieve no matter the President’s identity

He doesn’t believe the special relationship has any real meaning anymore and, in any event, even the fabled Thatcher/Reagan relationship didn’t give the UK any benefit in that area.

The pound remains volatile as the entire market awaits the result of the U.S. election. Yesterday, it traded between 1.3140 and 1.2914, closing at 1.2986.

The country returns to lockdown for a month from today with senior Cabinet ministers confirming that the restrictions will be lifted from December 2nd but unable to say what will happen next.

Every measure of the spread of infections is rising so the Prime Ministers decision is being proven correct but what happens next month will now become a serious issue.

Considering your next transfer? Log in to compare live quotes today.

Too close to call election to run and run

Trump’s ability to attract controversy like a magnet has been with him all through his business career and has accompanied him on what could turn out to be a brief sortie into politics.

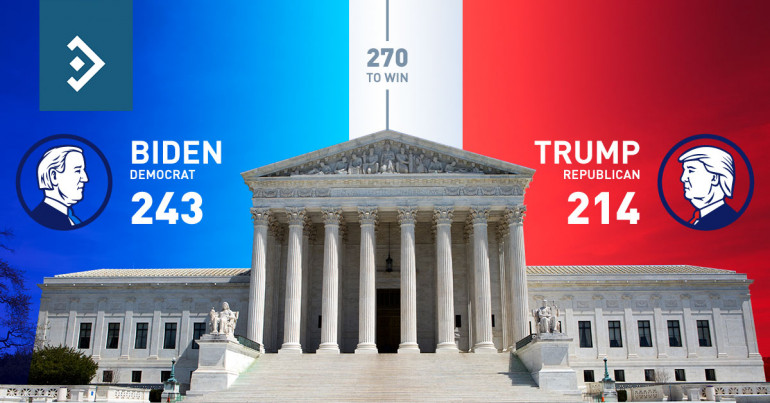

While he has done rather better than the polls predicted, Trump’s behaviour yesterday when he declared that he had already won the election but was in danger of being fraudulently cheated out of it, was fairly typical.

As President he has brooked no intervention, no contradiction and certainly no questioning of his policies. In fact, had he been able, he would probably have preferred not to have had a Cabinet at all, just a series of minions to do his bidding.

Now as he faces defeat by Joe Biden, the ignominy he feels he faces is so unbearable that he is mounting a challenge through the courts. It is doubtful he asked for opinion from his team, but this seems to be one outrageous action too far.

Yesterday was as extraordinary a day that the U.S. has seen politically in living memory. As every Swing State announced its result it became clearer that it was becoming tighter and tighter with even a tie being mentioned once or twice.

The three States where Trump is challenging the treatment of postal votes are Michigan and Wisconsin, where Biden is predicted to have won and Pennsylvania where a result is not expected before tomorrow. A Fourth, Georgia is likely to be held by Trump.

For financial markets which thrive on clear, calm outcomes and decision making, yesterday provided a level of volatility not seen for some time. The dollar index gyrated wildly. It traded between 94.30 and 93.25, closing unchanged on the day at 93.42.

Away from the election, the FOMC meeting will close later with no action likely other than repeated calls for the Pandemic Relief Bill to be agreed no matter the outcome. White House Advisor Larry Kudlow whose job hangs in the balance said yesterday that discussions would continue. He used the Term lame duck Congress while possibly really meaning lame duck President, when discussing who would be involved in making the decision.

The employment data has fallen under the radar. Today’s weekly jobless claims are expected to continue recent improvement, while tomorrow’s NFP report for October is being predicted to having added 600k new jobs down from September’s 661k.

Services still contracting

As lockdowns continue in France and Germany, there has been a fall in infections but it is still too early to say whether this will be sufficient for those two countries to return to normal, or at least something resembling normal, for Christmas. The rates of infection in Spain and Italy are continuing to rise with Belgium and the Netherlands also suffering.

The composite index of economic activity across the entire region fell to 50 in October, down from 50.4 in September. While still in a state of expansion, the trend is clearly for it to fall into contraction this month as output slows and dries up almost completely in those nations on lockdown.

The composite figure was dragged lower predominantly by the services sector which fell to its lowest level since May, of 46.9 from 48 in September.

With activity slowing it is hard to see the Eurozone surviving Q4 without falling back into recession.

The double dip is where a country or region manages to go back into positive GDP for a quarter only to fall back into recession the next. This is a clear outcome of the release of pent up demand which took place in Q3 only to be driven back into recession by the second wave of Covid infections.

The euro which has been seen as shadowing the dollar index for most of 2020 had a volatile day as the uncertainties in the U.S. fed through. It traded up to 1.1770, then fell back to 1.1602, closing marginally higher on the day at 1.1715.

About Alan Hill

Alan has been involved in the FX market for more than 25 years and brings a wealth of experience to his content. His knowledge has been gained while trading through some of the most volatile periods of recent history. His commentary relies on an understanding of past events and how they will affect future market performance.”