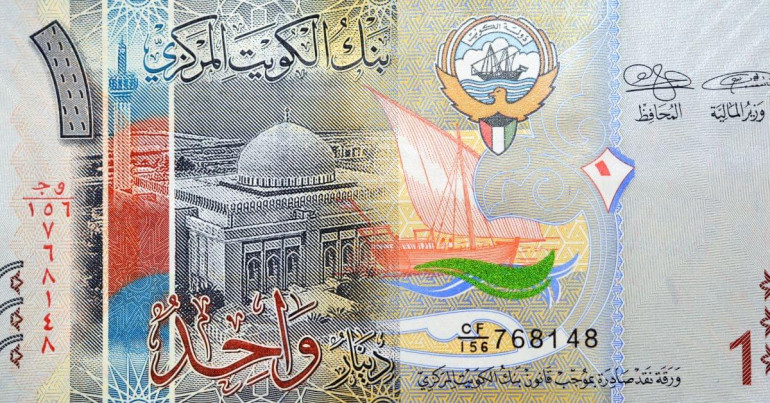

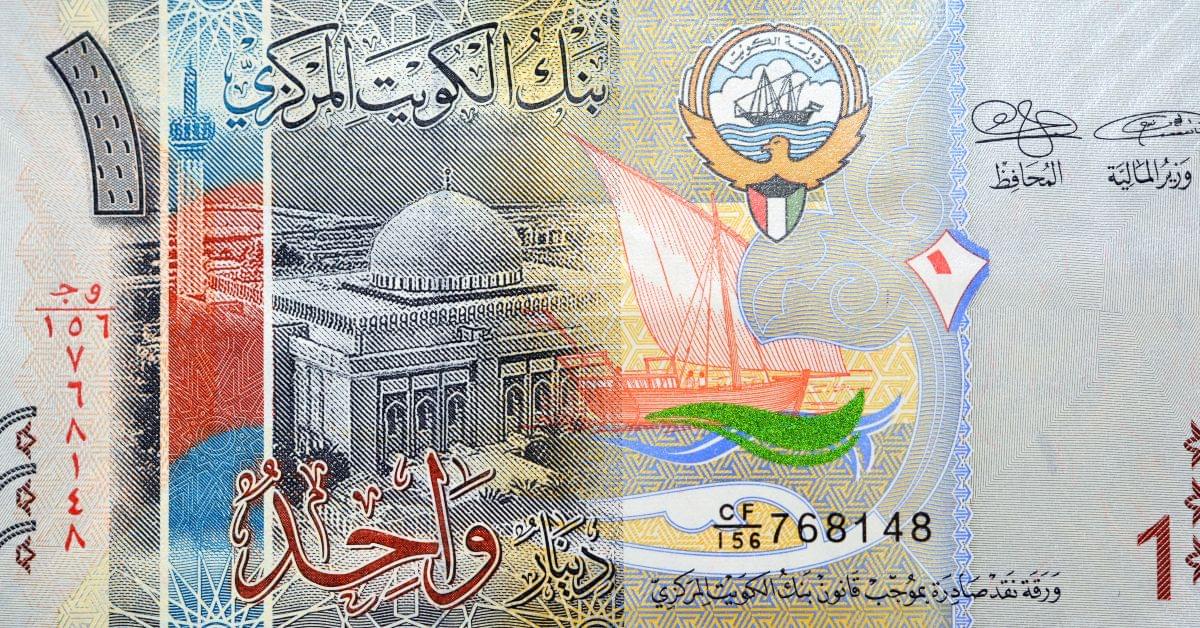

As you may have noticed in our top 20 currencies list, the top four most valuable currencies are the Kuwaiti Dinar (KWD), the Bahraini Dinar (BHD), the Omani Rial (OMR) and the Jordanian Dinar (JOD). The demand for these currencies is incredibly high, and the Kuwaiti dinar is currently the most valuable currency in the world. One Kuwaiti Dinar is currently worth £2.62.

Not all Middle Eastern currencies are strong, for example, the Yemeni rial has suffered recently, but the fact that the top four most valuable currencies are located in the Middle East is no coincidence. But why is this the case? What makes these currencies strong?

What makes a currency strong?

It is first important to establish what makes any currency strong. The strength of a currency is measured by its value against other currencies, and is constantly shifting as economies and politics change.

There are several main factors which contribute to the strength of a currency:

Economic stability

This is perhaps the most obvious, but if the economy of a nation is stable and also growing, it will generally follow that the currency is strong. This is because investors are always looking for secure places for their money, and an economy that can demonstrate stability is a good place to invest.

Low inflation rate

A high inflation rate will scare away a lot of investors, because it means that the purchasing power of the currency will decline over time. A low and steady inflation rate that is maintained over a long period of time will generally ensure that a currency remains strong, and that investors stay interested in the economy.

Higher interest rates

A higher interest rate will generally attract more foreign investment, as the demand for the currency is increased, and therefore has a higher value. This is because a higher interest rate will offer higher returns relative to other currencies for those who buy the currency.

Political stability

A general lack of political turmoil is good for a currency, as it reassures investors that there aren’t going to be any wild swings in the economy that will cause it to crash. Any conflicts or instability in the region can cause investors to pull out, and potentially cause the currency to plummet in value.

Foreign Exchange Reserves

Large foreign exchange reserves are good for a currency, as they demonstrate that a country is able to pay off its debts and also maintain the value of its own currency. It also increases the liquidity of a country’s economy, so they can resolve economic issues quickly if needed.

It’s also worth noting that some currencies, such as the US dollar and British pound have strengths over other currencies due to fixed exchange rates. For example, due to oil trades from many countries being in dollars, the US has managed to ensure that more US dollars are held in reserves than any other currency, thus ensuring its strength through necessity. Effective management of a currency in this way can also ensure its strength.

Why are Middle Eastern currencies so strong?

To answer why these top four currencies are strong, the biggest reason is their oil and gas reserves, and the management of their economies. Because these four countries are oil-producing nations, they have a commodity that is in extremely high demand, and their strong economic policies make them attractive to investors. The subsequent influx of money and investments from this further solidifies the strength of each currency.

Infrastructure developments

Huge developments in infrastructure have also contributed to the strength of some currencies in the Middle East. For example, Oman in 2010 was ranked as the most improved nation by the United Nations Development Programme for its rapid development in the prior 40 years. For investors, a country that is rapidly improving is incredibly attractive, and means that Oman presents the potential for quick and strong returns. Oman have also been working to diversify their income streams, and establish other areas of income that don’t depend on oil.

Relationship to the US dollar

The relationship of these economies and their currencies to the US dollar is another factor that ensures the strength of their economies. Due to the petrodollar, and the US’s sustained interest in oil-producing countries in the Middle East, it means that the US has a reason to help sustain these economies. Due to a lot of oil being traded in dollars, it also means that most of these nations have large amounts of dollars in their reserves, which in turn contributes to the strength of their economy.

The US has also made several deals with countries in the Middle East to ensure the dollar’s strength and in turn foster prosperity in the region. For example, in 2009, the US completed a free trade agreement with Oman, which eliminated all tariff barriers on consumer and industrial products, and extra protections for foreign businesses investing in Oman.

Future developments

Saudi Arabia’s recent suggestions at abandoning the petrodollar could suggest a wider move of these economies away from the dollar, and potentially towards the Chinese yuan. This could create a huge shift in these countries, and potentially incur sanctions from the US.

The Russia-Ukraine war has impacted the global oil markets, and interest in sustainable energy might also pose a threat to these currencies, as their income is heavily based on oil, despite some recent attempts to diversify.

But despite these factors, oil still has an optimistic future in the Middle East, with OPEC’s World Oil Outlook report stating that “oil is still expected to supply over 26% of the world’s energy demand by 2040.”

Furthermore, according to the Institute for the Analysis of Global Security, “by 2025, the number of cars will increase to well over 1.25 billion from approximately 700 million today. Global consumption of gasoline could double.”

These statistics suggest that oil has no intention of slowing down, or being replaced anytime soon by another fuel source. These Middle Eastern nations and currencies are likely to remain strong for decades to come.

Caleb Hinton

Caleb is a writer specialising in financial copy. He has a background in copywriting, banking, digital wallets, and SEO – and enjoys writing in his spare time too, as well as language learning, chess and investing.