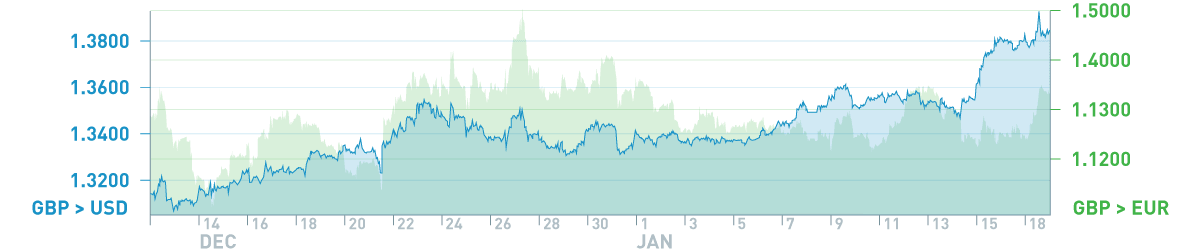

Will the Pound continue to rise versus US Dollar

Looking at the optimism that has been seen over the Brexit agreement, it seems to have been completely glossed over that that agreement was, in fact, close to a total capitulation. Furthermore, looking back towards last summer and autumn, any rally in the pound clearly coincided with periods of “consultation” where Brexit wasn’t making headlines. So, the first thing we should be aware of is that when talks start in early March it is entirely likely that the pound, irrespective of any macroeconomic data, will fall.

Inflation data still a major influence

Producer prices hit the headlines when they rose in direct correlation to the fall in the pound following the Brexit referendum. As Sterling has risen, their rise has slowed, but now, their influence over future inflation could be a negative. Interest rate changes are now applied in such small increments but their influence over currencies remains the same. The producer price data that was released yesterday surprised to the downside but while commentators concentrate on the current inflation data, future inflation is predicted by these numbers to fall with the consequent effect on interest rate expectations and the pound.

So, Can the pound remain at these levels against the US Dollar?

However, I cannot see any reason to be excited about the prospects for either the Brexit transition period or the trade deal that is to follow. Theresa May and her Cabinet have displayed their desire for “any deal is a good deal” which is a change in mantra from “no deal is better than a bad deal”. Brussels simply cannot afford for the UK to have anything that can be construed as terms of access to the single market that;

- encourage further unrest or

- are more beneficial than other non-EU members access (e.g. Norway or Canada).

There is little reason to believe that these are “one time only prices but since the pound has reversed close to 50% of its post-referendum fall, it may not have that much more headway to the upside and those with dollars to buy could see this as an advantageous level to hedge.