- The banks desire to become more profitable from non-lending related products.

- The improvements in regulation that have provided more security.

- The desire of Fintech businesses to provide competitive pricing and first-rate customer service.

Payment processing was, for a long time, globally the province of banks. They created the investment in systems like SWIFT but have been rapidly overtaken by Fintech firms who take a more creative approach.

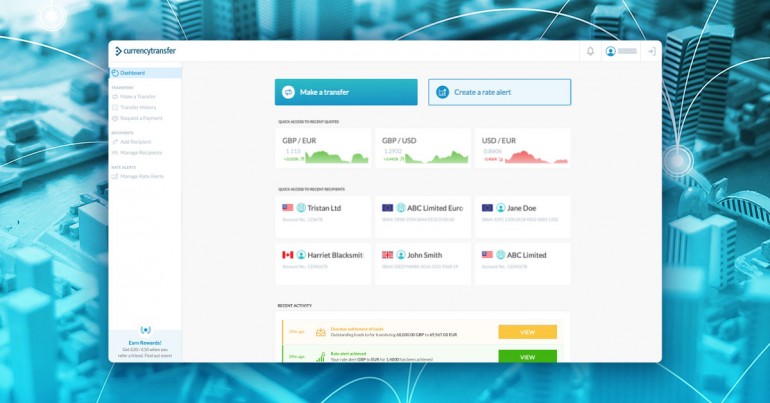

Enjoy the best business money transfer deals with CurrencyTransfer.Com – Sign up today!

If a customer had approached a bank as recently as ten years ago, promising to pass all their foreign exchange business through the bank in exchange for a preferential rate, they would have most probably been told that in order for the bank to continue to provide a line of credit and other ancillary services, the bank demanded that all foreign exchange was handled by the bank.

While pricing is still a major criterion for FX related companies to win business, it is also service which is a major contributor. Price has become far more transparent with the spread over the interbank price being both clearly visible and negotiable.

Fintech businesses which specialize in foreign exchange will enter a discussion with any customer regarding a bespoke service whether that relates to volume of a specific currency or type of payment. Banks were often reluctant to enter into agreements with customers over FX rates as they were time consuming and difficult to administer.

With CurrencyTransfer.Com you can transfer money at the best global rates – every time!

Currency volume is one of many reasons a customer may be able to negotiate a bespoke arrangement with a broker. To find out the benefits of dealing on level terms rather than being under the “spell” of a bank, it pays to understand just what a fintech based broker can offer in terms custom payment processing as well. This is possibly a less tangible benefit but the service you will receive, and the assistance should anything go wrong will be second to none.

About Alan Hill

Alan has been involved in the FX market for more than 25 years and brings a wealth of experience to his content. His knowledge has been gained while trading through some of the most volatile periods of recent history. His commentary relies on an understanding of past events and how they will affect future market performance.”