A Guide To International Educational Payments

In today’s guide, we’ll show you how you can save up to 85% and never get a raw currency deal again.

Currency Transfers cost students thousands unnecessarily

At CurrencyTransfer.com, we’re seeing more and more foreign students apply to join the marketplace to find the best exchange rates. So, with a new semester and school year coming, here’s your complete guide to being frugal when making overseas tuition fee transfers.

Compare & Save 85%

Like 85% of international students, you instinctively would think that your bank is the natural place to go to make international educational payments. Herein lies the problem. A little research will show that there are now a wealth of transfer options, from non-bank currency brokers, P2P and comparison marketplaces like CurrencyTransfer.com.

Currency Exchange is highly opaque and very confusing. As such, we’re seeing a huge wave of tech innovation and funding going into the sector. There’s never been a better time to score a great deal on education transfers! Step 1: Shop around!

Hidden bank fees are costly

Specialist Non-Bank FX providers call into the live markets. They will take on average 1% or less, depending on the volumes and frequency. In short, you could save x10 times or 85% versus hidden bank fees by using a foreign currency specialist for your overseas tuition transfers.

Top Tip: Ignore slogans of 0% commission! It’s marketing guff. No transfer fees but a terrible exchange rate is going to land you a very poor deal.

Send money abroad online for the best exchange rates

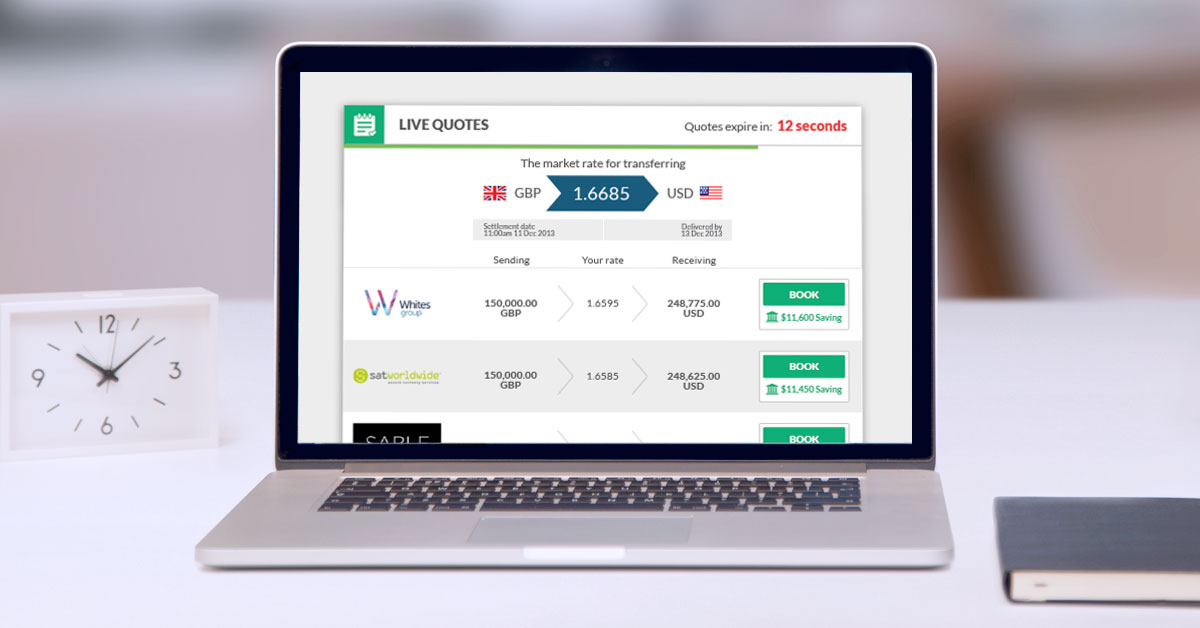

Making transfers online are always more transparent, particularly if you use a platform or marketplace which shows the true mid-market and your rate side by side.

Know how to deal with currency fluctuations

Forward contracts are typically offered by currency brokers and reputable online trading platforms. It’s always worth speaking to a trusted and experienced account manager before booking this type of transfer. Nobody has a crystal ball nor qualified to advise, but a currency purchasing strategy can be discussed.

Ensure you convert currency with a trusted and transparent supplier

Questions to ask your currency broker

- Are you FCA authorized and regulated?

- How many tuition related transfers do you make on an annual basis?

- Does your firm protect funds in segregated client accounts?

- Do I lock in LIVE rates or simply estimated rates?

- Do you offer forward contracts, if so, is there a deposit required?

- Can I make transfers online? (beware of sales guys trading you over phone*)

We live in a global village. As such, we expect the need for large overseas tuition transfers to continue growing at a rapid pace. The experienced and friendly team at CurrencyTransfer, together with our award-winning online marketplace will be here to support students worldwide find and book the cheapest and best exchange rate transfers on the market.

Register today and you’ll be allocated a Personal Currency Concierge who can help understand you’re requirements.