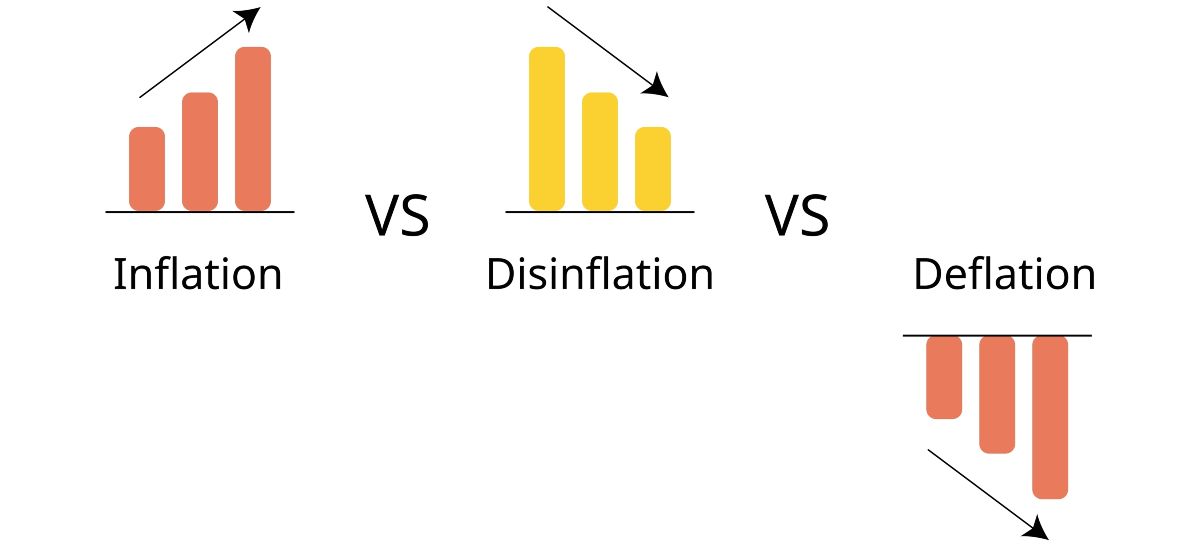

In order to answer what deflation and disinflation are, we first need to define what inflation is. Inflation is the increase in prices of goods and services, meaning that if there is inflation in an economy, things will become more expensive. Most economies in the world will have some degree of inflation.

The rate of inflation is measured as an annual percentage, which will be calculated by the Office of National Statistics (ONS). They will analyse approximately 180,000 prices of 700 products. This analysis will then form the Consumer Prices Index (CPI), which is then used to find the rate of inflation.

The UK is currently in a period of high inflation of 10.1%, and the Bank of England has been increasing its interest rates since last year in an effort to reduce these inflation rates and avoid a recession. While the UK managed to recently avoid falling into one, it is not out of the woods yet.

Recently, there has been talk of disinflation, and the ‘disinflationary process’. But what is disinflation, and is it the same as deflation?

What is disinflation?

Disinflation is simply a term to denote when inflation is slowing down, or not ‘inflating’ as much as before. Disinflation is a reduction in the inflation rate, but not the reversal of it.

It is generally agreed by banks, and actually agreed between the Bank of England and the UK government, that the inflation rate needs to be at 2%. If the inflation rate rises beyond this, then banks will need to step in to try and reduce it. For example, the inflation rate is at 10.1% in the UK at the time of writing, which means that within one year, all goods and services will be 10.1% more expensive. The Bank of England has increased interest rates, which has been done to cause disinflation, and therefore reduce the inflation rate.

Why do we need to reduce inflation?

Too much inflation can be devastating for an economy and can even destroy a currency in some extreme cases, as the currency will have less and less spending power – to the point of becoming worthless.

The highest rate of inflation ever recorded was in Hungary in 1946. In 1919, after a few years of political instability, the inflation rate hit a monthly rate of 90%, causing the country to spiral. By 1945, things had taken a turn for the worst, and by 1946, the inflation rate had rocketed to 41,900,000,000,000,000% (41.9 quadrillion percent). This inflation rate meant that prices doubled approximately every 15 hours, which was so frequent that prices had to be adjusted each day by radio announcement. The hugely inflated pengő was eventually abandoned and replaced in August 1946 by the forint, which Hungary still uses today.

This is not an isolated incident, and hyperinflation has happened many times. While it normally happens during times of notable instability, it demonstrates that an economy can drastically change if the correct measures aren’t implemented, and shows how important disinflation is to stop uncontrolled inflation.

What is deflation?

Deflation is the opposite of inflation, and means that the prices of goods and services will decrease, meaning everything gets cheaper. At face value, this can seem like a good thing, as you’re getting more for your money, but deflation is actually a cause for concern. The effects of deflation are slightly more complicated than inflation, and many economists disagree on its true effects.

While high inflation is dangerous for an economy, deflation can have many negative effects too. One of the biggest blows that deflation can cause is to borrowers, who are still tied to debts in money that is now more valuable, so in effect, the real value of their debt has increased. This can also apply to the financial markets, as investments will generally start to lose their worth, so people will invest less. The Great Depression is one of the most notable examples of widespread deflation.

There has been long debate in the economic world about the true effects of deflation, and the extent of its effects. Much like inflation, there are many who argue that a small amount of deflation is healthy for an economy. According to this report from the NBER, “a basic tenet of monetary theory – the Friedman rule – suggests that deflation (albeit perfectly anticipated) is an outcome of optimal monetary policy.” The report posits that the deflation seen throughout history has been “essentially good or neutral”. However, there have been many damaging effects of deflation, for example, triggering a deflationary spiral.

What is a deflationary spiral?

Due to deflation causing everything to get cheaper over time, people will want to wait before they make a purchase, as prices will be getting gradually lower. In the short term, consumers may benefit from this, but it will begin to have a compounding effect. More and more people will wait to get better value for their money, and therefore spending will decrease, and deflation will speed up as businesses struggle to make sales. In response to this, businesses will slow production, lay off staff and resort to salary reductions as they try to survive the drying up of spending which lowers the spending even further. This is known as a deflationary spiral.

Is inflation good?

This is a question that economists still disagree on and discuss in depth. But it has been generally decided now that a low amount of ‘predictable’ inflation is overall beneficial for an economy.

One of the main reasons is that the same way customers will reduce spending under deflation to get a better deal in future, customers will generally increase their spending under inflation, as goods and services will become more expensive over time. This can prove a vital boost to economic activity. There is also the Phillips Curve diagram which suggests that there is a direct link between the increase of inflation and the increase in jobs, and that reducing inflation can actually contribute to unemployment.

If you’re concerned about inflation and would like to stay up to date with the latest news, subscribe to our newsletter here.

Caleb Hinton

Caleb is a writer specialising in financial copy. He has a background in copywriting, banking, digital wallets, and SEO – and enjoys writing in his spare time too, as well as language learning, chess and investing.