The jury is still out as to whether or not China presents an untapped resource which rewards the brave investor, or a monetary mousetrap which allows capital to flow in, but never out. Whatever the opinion, China is simply too big to ignore.

Were it any other country, China’s history of rapid economic growth over the past two decades would have prompted an influx of foreign investment. Emerging economies tend to lure in foreign capital with the promise of continued growth or just a quick buck. Importantly, China’s one-party-policy grants it unprecedented control over domestic markets. This should embolden investors who can thus more safely finance their exploits without the risk of unprecedented swings in the market, but this has not proven to be the case.

Above all, it would appear that it is not monetary concerns that cause investors to shy away from Chinese markets but morality. The global community has not seen fit to overlook Xi Jinping’s brutal totalitarianism. As China continues to make headlines for its humanitarian abuses, the chasm between the Chinese market and foreign investors will only grow.

China’s capital controls

China has imposed increasingly strict regulations governing the flow of money in and out of the country. The laws that apply to Chinese nationals are markedly different from those that apply to foreigners and foreign-owned businesses.

China’s capital controls have formed the backbone of its economic development over the past decade. China has geared its monetary policy around restricting the outflow of capital and currency. This forces domestic households and businesses to reinvest their money into the Chinese economy instead of foreign enterprises.

China relaxed its capital control schemes in the early 2000s. This ended in 2016 with the collapse of the Chinese stock market. When the bubble popped, Chinese nationals owned 98.5% of Chinese stocks.

The collapse triggered a wave of panic and a flight of capital from the Chinese economy. The Chinese government clamped down in response. While the initial measures may have intended to be temporary, China has yet to back down from its approach of “financial repression.”

China seeks to insulate itself from the West

China’s new economic model appears to be one of internal circulation, domestic markets and independence from global imports. It has consistently lowered its reliance on imports, while the value of its exports has remained somewhat stable.

Souring global opinions towards China’s foreign policy has shaped China’s economic disposition over the past twenty years. Having seen the efficacy of US sanctions against Russia, China now seeks to insulate and protect its economy from any international backlash in response to ongoing territorial disputes in Hong Kong and Taiwan.

Research published by Peking University in 2018 (which was subsequently deleted) showed that China cannot independently manufacture many critical technologies, including GMO seeds and semiconductors. Most important is its lack of control over core computing systems, directly affecting its military and aerospace capacities.

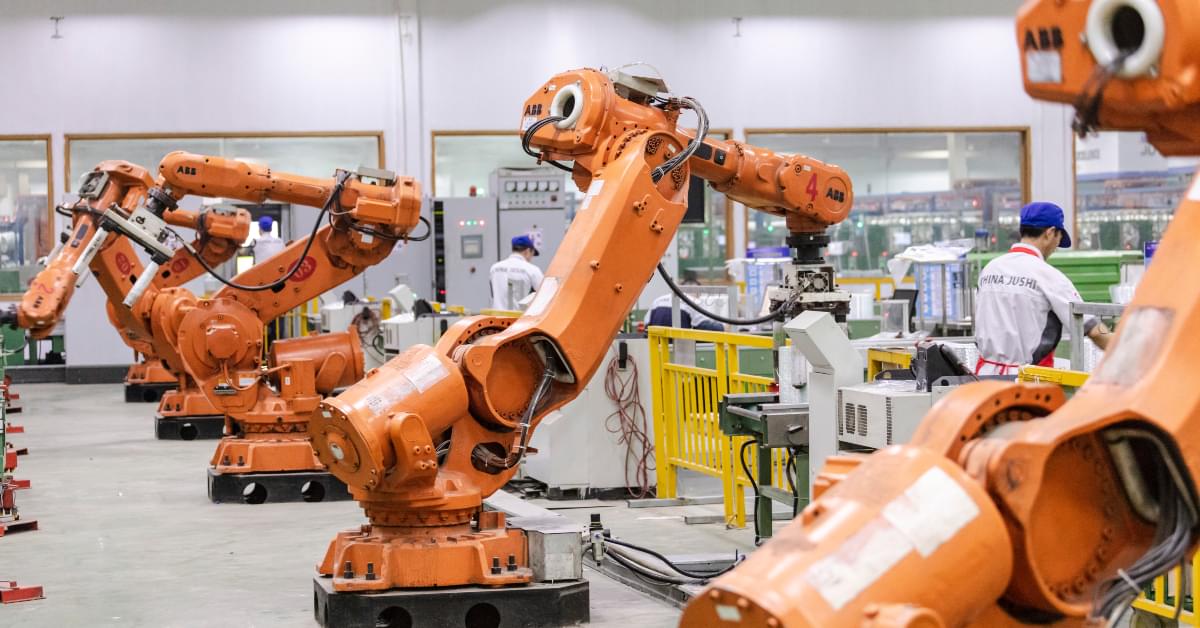

To remedy this, China has turned its attention inward, focusing almost exclusively on domestic manufacturing. Chinese banks play a lead role in fulfilling this goal. China has few privately-owned banks, and those allowed to operate have little chance of breaking the state-dominated banking monopoly. Capital controls funnel money into China’s national banks. State banks then channel national savings towards whatever industry the Chinese government desires to expand. This policy has led to several issues, including what some think is an artificially inflated GDP.

China recently doubled down on their efforts by banning the trade of virtual currencies like BitCoin and Ethereum. Official statements claim that such measures combat money laundering and fraud. China has since launched its digital yuan currency (e-CNY), suggesting that the ban was another attack on privatized commodities and another step towards a state-owned bank monopoly.

Foreign trade prospects in China

What does all this mean for foreign investors, migrant workers and business owners?

Opportunities for investment in China are limited. China is still a Marxist-Communist state, and its policies have placed increasingly harsh limits on private enterprises. Xi Jinping’s regime has made it clear that private companies will always play second fiddle to state interests. It is particularly hostile towards foreign-owned enterprises trying to enter the Chinese economy.

Stock investors also face severe restrictions. While anyone can buy those Chinese stocks listed on US exchanges as American Depository Receipts (ADRs), the only way to access non-ADR shares of China-based companies is through the Hong Kong stock exchange. This necessitates opening a brokerage account in Hong Kong, which comes with its own difficulties.

The apportioned capital controls make moving large amounts of money out of China virtually impossible. Migrant workers can exchange their net income for foreign currency. Beyond this however, they cannot purchase more than $500 USD worth of foreign currency a day.

Foreign-invested enterprises (FIE) and Wholly Foreign Owned Enterprises (WFOE) in China must report all overseas transactions of $7,600 USD or more. The threshold in 2017 was $30,350 USD, which China lowered as part of its lockdown on the local currency. Approval of these transactions is subject to intense scrutiny and can be denied for any reason. The approval system is opaque to foreign business owners and, if denied, offers no alternate course of remittance.

Despite this, there remain competing opinions on investment in China. Some advisors might recommend staying out, while others advocate staying in and repurposing. Long-term investors are unshaken by recent events. China’s regulatory policies have only targeted a selection of investment opportunities; many others remain viable options.

China’s dual-currency explained

Those familiar with the exchange of foreign exchange in China may be aware that China has two functional currencies. Contrary to popular belief, China does not have three currencies – a Yuan is a unit of the Renminbi, just as the Pound is a unit of the Sterling.

China trades in the Chinese Yuan (CNY) and the Chinese Hong Kong Dollar (CNH). Both are units of the official Chinese currency, the Renminbi (RMB). Local traders in the Chinese mainland use CNY to trade. CNH is the offshore version of the RMB. Currency traders can purchase CNH freely on the global market.

One might think that because CNY and CNH are units of the RMB that 1 CNY = 1 CNH = 1 RMB, but this is not the case. The value of the CNH fluctuates based on the volume traded in the international foreign exchange market. The People’s Bank of China (PBOC) tightly controls the value of the CNY. The value of these currencies is often comparable, but the respective values of the CNY and CNH sometimes diverge. The PBOC works with a secondary regulator, the State Administration of Foreign Exchange (SAFE), to determine the daily value of the CNY relative to the CNH. Traders on the Chinese Mainland can trade within 2% of the advised rates.

This has interesting implications for anyone trading in either CNY or CNH. If you’re sending money to China, you must do so in CNY, which the PBOC regulates. If you receive money from China, it will be in CNH, which the Hong Kong Monetary Authority regulates. This doubles the potential risk of dealing in RMB as you stand to lose on the conversion between CNY and CNH depending on domestic market conditions.

China’s currency manipulation

The distinction between CNY and CNH effectively allows China to control the value of its currency. In 2019 the US accused China of manipulating its currency as the CNY rapidly devalued the yuan in response to new tariffs imposed by the US. China allowed the yuan to fall below the 7:1 CNY/USD rate it had maintained since 2015, which prompted the rapid selling of Chinese commodities in global markets. This statement was quickly withdrawn but revealed the extent to which China could independently dictate the value of its currency.

How to send money to China with CurrencyTransfer

Due to the difficulties of dealing in local Chinese currency, most who hold interests in mainland China will conduct transactions in USD. In 2013, China held the world’s largest repository of USD.

Choosing to instead deal in CNH (then converted to CNY) can help alleviate the risks involved and provide the following benefits:

- Chinese suppliers may prefer to settle in local currency as it improves price transparency

- Traders in mainland China trade within a CNY/CNH price band advised by the PBOC. Using CNH allows suppliers to trade without an added exchange rate buffer, which avoids any renegotiation of purchase prices.

- CNH can be traded as a deliverable forward currency. Purchasers can better manage risk by hedging, and benefit from better forward point gains when compared to an equivalent USD transaction.

At CurrencyTransfer, we help you save money when you purchase Chinese Yuan from all other major currencies, including EUR to RMB, USD to RMB and GBP to RMB. Our currency concierge team is available to answer any questions you may have, feel free to contact us.

Matthew Swaile

Copywriter

Florence Couëdel

Editor