One of the largest obstacles of scaling your business is import/export finance challenges. Import Finance gives UK SME’s flexible credit options that solve cash flow problems. When importing from abroad, you may need to manage a myriad of potential pitfalls, including: working capital, trust with new export relationships, fluctuating exchange rates, and supply chain management. As an ambitious importer, strategically utilising the best import finance options will enable your business to access the adequate amount of capital to grow your business and expand your market share.

What Are Import Loans?

Import loans come in many forms, but they’re defined as a short-term advance of cash from a bank or non-bank lender to an import business. This importer might lack the capital to pay a supplier, and consequently, to fulfill outstanding obligations to its own customers. Essentially, import finance is a credit facility so that the importer can purchase goods and continue to do business, managing cash flow issues smartly along the way.

Who Needs an Import Loan?

Below is a list of sample industry types that rely on finding the best value import loans and financing with which to succeed in their industry.

Companies Using Raw Commodities

Companies that import commodities like agricultural products, oil, livestock or even precious metals for use in manufacturing are typically customers that would require import loans. These importers are one link on a chain between suppliers and the importer’s own customers, and so depending on market conditions, they need to leverage their cash flow and accelerate the time between when they must pay for imported goods and when they’re paid for the products that incorporate them.

eCommerce / eTailers in the UK

eTailers need import finance to fund the purchase of stock. Those that do their own fulfillment and warehousing, and who sell products online from their overseas suppliers can get an import loan, even if they don’t have confirmed buyer in the UK. Online retailers that need to contend with seasonal businesses can reduce risk.

Construction Companies

Importing heavy machinery is a capital-intensive effort and therefore commonly makes use of bridging finance—a type of import loan—to ensure that payment isn’t released until the equipment makes it onshore in one piece.

Small and Medium-Sized Enterprises

SMEs that import to the UK are ideal candidates for import finance. Security and certainty around trades is required, whether you are a small, growing or mid-cap UK SME importer.

Benefits of Import Loans

There are many benefits to taking import loans. Import finance is vital to international trade and keeps the market moving without friction, helping importers (buyers) and exporters (suppliers) to manage critical relationships:

Optimize Cash Flows

The biggest issue that importers face is the lag time between when they need to pay their exporters to send new goods, and when they receive money from their own customers. Working capital can often tied up in a new order or in an invoice, and an import loan acts as a bridge between the two.

Improve Bargaining Power

With increased liquidity, less cash contraints and flexible access to capital, an importer has leverage with its supplier abroad. It can release payment for new goods on a faster schedule and comply with payment terms that require trust, because the lending bank shoulder the burden of collecting payments in many cases.

Enhance Your Reputation

With greater, faster purchasing power, an importer can more quickly establish relationships and prove that they’re capable of operating in good faith and settling trades in a timely manner. This opens new opportunities and strengthens established relationships with both existing and new trading partners.

Bank & Non-Bank Requirements for an Import Loan

UK SMEs need to be aware of their bank or lenders requirements for obtaining an import loan. Every lender will have their own scoring system and threshold when the importer is looking to advance funds. Risk appetite can vary wildly.

You’ll need to prepare plans, forecasts and anticipated results. A high credit score is helpful for obtaining an import loan, but since they’re based on single transactions and not past performance, it isn’t mandatory. However, lenders in the UK usually want to see that an importer has been in business for a minimum period of time (usually one year, but subject to lender) and has successfully transacted with exporters previously.

Standard requirements include:

- Beneficial owners, directors and cap table

- Financial Statements, Audited

- Business case

- Cashflow forecasts

- Creditor summary

- Liabilities

Because most import loans are based on accounts receivable, documentation from the exporter is also critical. Make sure to bring along the original contract and other communications that help the lender determine the credibility of the exporter.

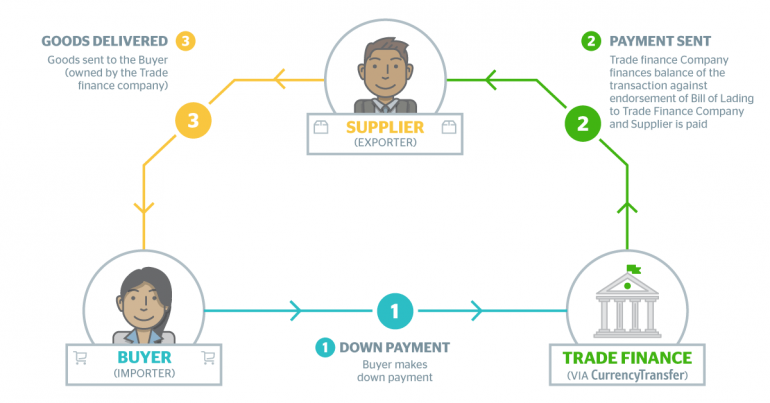

A cheaper but higher risk form of trade finance is Documentary Collections. The sale of goods is settled with banks via the trading parties exchanging documents. In this case, the supplier (exporter) would provide confirmation to the bank that the products have been released, which normally comes in the form of a bill of lading. Once completed, the exporter would receive payment in the settlement of an invoice. Risks can arise in the event if importer doesn’t accept goods, the bank won’t settle. Title to the goods only takes effect with payment, so in theory the exporter can recover goods. In practice, the recovery of goods from a far away country can be time consuming, hard to obtain and costly.

Non-Bank Import Loan Providers

With many banks in the UK becoming more conservative in their lending standards, options for obtaining trade finance are drying up. Thinning margins and external pressures combine with the increasing costs of running a profitable trade financing department, meaning that importers are only able to obtain loans from those with appropriate risk appetite. You may want to consider the following:

Capital Markets Entities

Private, non-traditional financial companies are in the business of trade finance. Many are staffed by former bankers, and can tolerate riskier lending strategies that a bank wouldn’t touch.

Hedge Funds

An SME importer based in the UK might also ask for a loan from a hedge fund, which are investing in this niche more often due to its potential returns. Not all funds are open to trade financing, though some specialized ones will be happy to take new business.

Online Lenders

With the growth of technology comes leaner, mobile, FinTech focused business credit models. This includes lending, and an importer can now go online to find trade financing options. Aggregators and free marketplaces for business lending will allow you to initially compare indicative rates and connect you with an advisor who will look to finalise your import finance requirements.

Consider Business Foreign Exchange (FX) For Importers & Exporters

With your import finance secured, fast growing UK SME’s shouldn’t overlook the optimisation of business currency solutions. Constantly fluctuating exchange rates cause a headache for importers in the UK, who need to pay suppliers in a foreign currency. Every day, the price of your imports could change. Depending on the current rate, this could mean paying much more, or much less for the same number of goods. CEO’s, Finance Directors and the board should adopt a robust currency risk management strategy.

Global payments marketplaces like CurrencyTransfer.com help make this part of the international trade process much more digitised, transparant, fast and cost-effective. The average UK high street bank will give limited tools to manage currency risk for businesses, and apply huge hidden fees and markups in the rate. Using the CurrencyTransfer.com marketplace can save up to 85% in hidden fees, allow you to access currency hedging (e.g. forward contracts) and provide a relationship driven service. This will allow you to make your import business even more competitive.