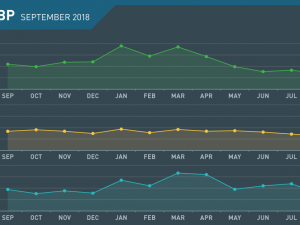

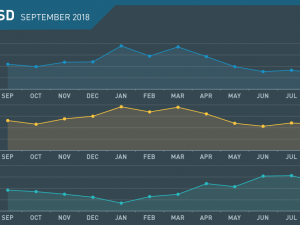

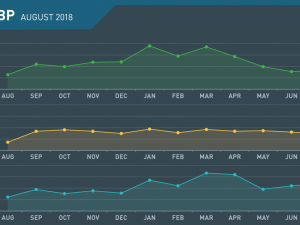

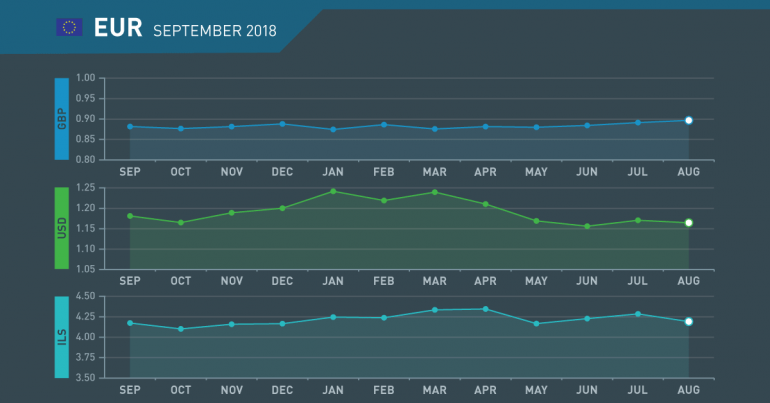

EUR Monthly Review September 2018

August in review

A sleepy, reactive month

- Rise against GBP bringing concern

- Macron popularity falling

- Economic activity indexes falling

- Italian bridge disaster led to Government u-turn

Exporters concerned over Euro rally vs. pound

Eurozone exporters are expressing concern over the rise of the Euro against Sterling as it is seen giving a boost to UK firms.

“King” Emmanuel lurches right

French President Emmanuel Macron is being accused of acting like “a king” as he enacts policies that favour the rich and big business, which is contrary to his centrist manifesto.

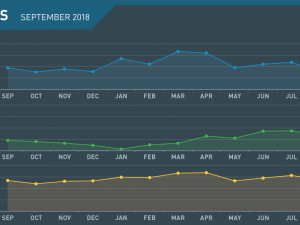

Economic activity levels slowing

The levels of economic activity in the Eurozone as predicted by Purchasing Managers Indexes are slowing, which could lead the ECB to delay the removal of support.

Italian Gov’t must fund infrastructure not welfare

The new Italian Government had abandoned plans for infrastructure development prior to the Genoa bridge disaster. Now they must revise policy to react to public safety concerns.

September what to watch

Italy ease of restrictions

- Italy desperate to increase debt ceiling

- Weidmann’s star is fading

- Turkish issues yet to be resolved

- Delay in end to QE a possibility

Italy on collision course with Brussels

Italy wants to raise its debt to GDP ratio, which is currently more than 130% to deal with “Genoa” and make good on its welfare reform plans. This is unlikely to be seen positively in Brussels or Frankfurt and could lead to a major dispute, which if taken to its logical conclusion could see Italy depart the Euro citing its own population over the EU.

Merkel unlikely to back Weidmann for ECB

Angela Merkel wants a German as EU Council head. She is therefore unlikely to jeopardise that by promoting the candidacy of Bundesbank President Jens Weidmann for ECB head. In what would then be an open race the Irish Central Bank Governor is seen as a sensible compromise candidate.

Eurozone bank’s exposure to Turkey a concern

The spectre of contagion returned with concerns over Eurozone bank exposure to Turkey. Fresh regulation is needed from the ECB that regulates total exposure across the entire region.

Slowdown could lead to QE removal delay

The scheduled removal of the Asset Purchase Scheme could be delayed or cancelled entirely if a slowdown in the Eurozone looks likely. ECB President Mario Draghi has already intimated he would be in favour of such a move if economic activity slows substantially.

Tuesday

- PPI m/m

Wednesday

- Retail Sales m/m

Thursday

- ECB Press Conference

Monday

- Final CPI y/y

Tuesday

- Ger ZEW Economic Sentiment

Wednesday

- German PPI m/m

Monday

- French Services PMI

- German Manufacturing PMI

- German Services PMI

- Services PMI

- Manufacturing PMI

Thursday

- M3 Money Supply

Friday

- German Retail Sales