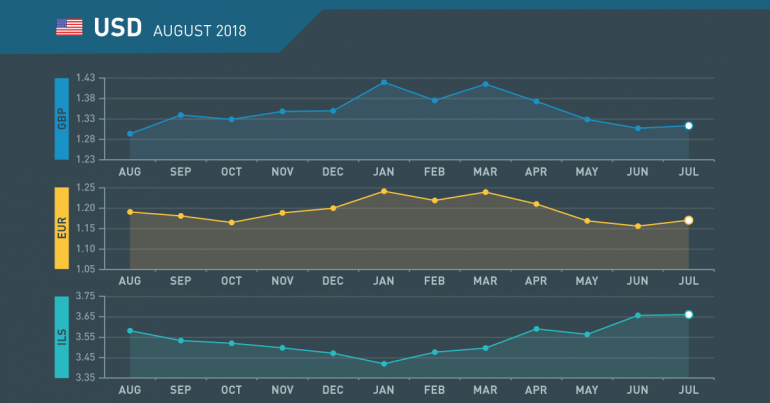

USD Monthly Review August 2018

July in review

Trump Concerned Over Dollar

- President fears rate hikes will slow economy

- Q2 GDP justifies Powell decisions

- Trump holds effective talks with Juncker…

- …but savages EU over Brexit & NATO over spending

Q2 GDP at four-year high

President Trump voiced concerns over monetary policy in the U.S. as GDP in Q2 reached 4.1%. When discussing growth, and taking credit, he hedged over future levels as he had already criticised the pace of hikes in short term rates by the Fed.

Inflation & growth data prove Powell to be right

Not only did Q2 growth come in close to the top of expectations, PCE, the Fed’s favoured measure of inflation fell from a revised 2.2% in Q1 to 2% in Q2. This goes some way to justifying the Fed’s planned interest rate path.

Trump and Juncker hold “positive” talks

It was easy to get carried away with the talks held by the U.S. President and his EU counterpart. Trump clearly felt it was not the right time to discuss the auto industry and so little of consequence was discussed and the event will fade like with the Trump/Kim summit.

Trump criticises NATO & Brexit

On a visit to Europe, in which he also had a non-summit with Vladimir Putin, Trump savaged NATO nations spending record and called for a no-deal Brexit. His comments were ignored by the EU but got some headlines in the U.K.

August what to watch

Trade Concerns To Remain

- Trade war with China continues

- Monetary policy to drive dollar higher

- Employment rate set to top out

- Wage inflation to rise again

Trade war simmering for now

The trade deficit grew in June but there was no comment from Trump as the next moves in the trade war are considered. It is possible that new tariffs will be enacted by both the U.S. & China but moves over ownership are more likely to be next.

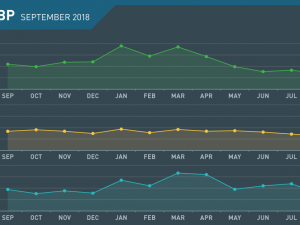

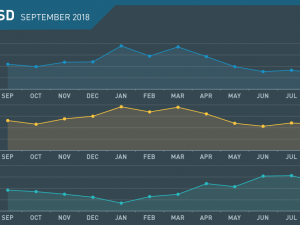

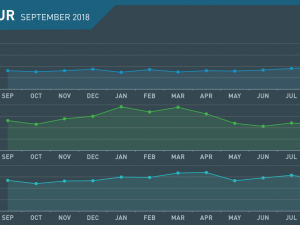

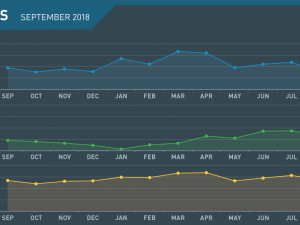

Monetary policy to be key dollar driver

Similar to Sterling, where is the key driver and other macroeconomic issues are seen as minor short-term issues, so it will be for U.S. monetary policy. The larger the interest rate differential becomes the more the dollar will rise overall.

Jobs growth to slow

Unless the new economic paradigm post-financial crisis has brought new levels of employment not seen before in the G7, U.S. employment growth has to slow in the coming months, despite the GDP Data. This may bring concern to the Fed long term but the rate hike strategy appears set in stone for 2018.

Wage inflation steady but set to fall

It would be no surprise inflation if wage inflation remained a 2.7% for the third month in a row when it is released in the first week of August. As available jobs numbers fall, wage demands will fall.

June 2018 : Key Events

Wednesday

- ADP Employment Change

- ISM Manufacturing PMI

- FOMC rate decision

Thursday

- Unemployment Claims

Friday

- Average Hourly Earnings m/m

- Non-Farm Payrolls

- Unemployment Rate

Thursday

- PPI m/m

- Unemployment Claims

Friday

- Core CPI m/m

- Monthly Budget Statement

Wednesday

- Retail Sales m/m

- Empire State Manufacturing

- Industrial Production

- Building Permits

- Housing Starts

- Phily Fed Manufacturing Index

Thursday

- Building Permits

- Housing Starts

- Phily Fed Manufacturing Index

- Unemployment Claims

Tuesday

- Mortgage Delinquencies

Wednesday

- Existing Home Sales

- Crude Oil Inventories

- FOMC Minutes

Thursday

- Unemployment Claims

Friday

- Durable Goods Orders m/m

Tuesday

- Consumer Confidence

Wednesday

- Advance GDP q/q

Thursday

- Personal Spending m/m

Friday

- Chicago PMI