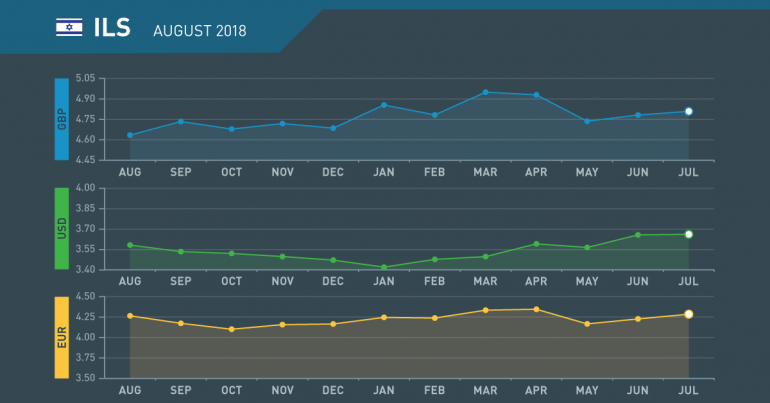

ILS Monthly Review August 2018

July in review

Shekel Higher After Comments

- Q1 growth revised higher

- Housing market taking off

- El Al/Air India dispute unresolved but shelved

- Relationship with China adds volume to enterprise

Growth continues to rise

Q1 growth estimates were raised again in July as the economy grows at a pace despite concerns about its ability to sustain growth more than 4%.

Housing market shows solid base

The housing market is starting to have a significant effect on all aspects of Israeli life. The market is “booming like crazy” with activity in suburbs of Tel Aviv at an all-time high.

Air travel dispute shelved

El Al has shelved plans to contest the right of Air India to gain a competitive advantage from its ability to fly between India and Israel using Saudi airspace. This will clear the path for further negotiations.

China deals add volume to enterprise

The growing relationship between Israel and China has given Israeli enterprise access to Chinese manufacturing capability. This can sustain growth and maintain trade links.

August what to watch

Shekel Retreat As Dollar Rally

- Tech invasion raising concern

- MoF to raise more funds after record low issue

- Rating rise to aid future development

- Debt to GDP ratio to continue fall

Concerns mounting over cyber-terrorism

While there has been a lull in violent terrorism, concerns are growing over state sponsored cyber-attacks on Israeli infrastructure.

Shekel in thrall of dollar actions

The Shekel rallied following President Trump’s tirade against dollar strength and this will likely continue which will have a positive effect on inflation.

Improving debt rating adds to economic hopes

Moody’s raised Israel’s debt rating to positive which is encouraging following the recent bond issue and will encourage the MoF to act again.

Debt to GDP ratio to fall despite new issues

The positive international attitude to Israeli debt could see the MoF come to the market soon, especially since with growth above 4% the debt to GDP ratio is still falling.