European Commission says No to City Deal

Morning mid-market rates – The majors

February 1st: Highlights

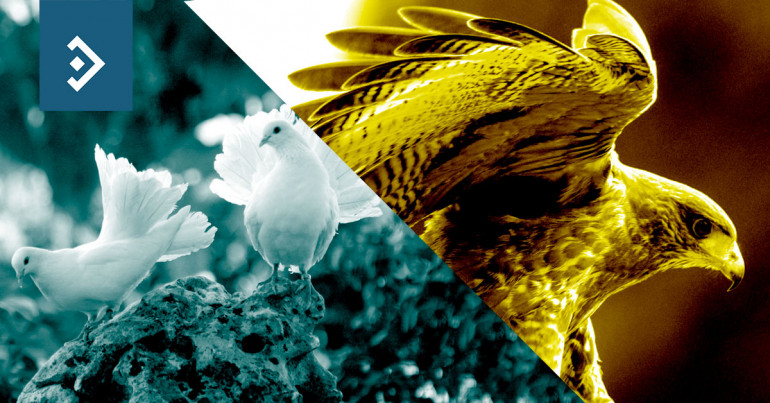

- Brexit disagreements starting to mount

- FOMC more hawkish than expected

- Eurozone Inflation cools need for monetary policy action

Free movement and single market drive Brexit worries

The size of the task facing negotiators from both sides is now beginning to become a reality as first UK Prime Minister Theresa May, in China for trade talks, said that there would be no “special arrangements” for EU citizens who arrive in the UK during the transition period. This means that they will not have the same rights as those who arrive before March 29, 2019 and will be treated in the same way as all immigrants following the end of the transition period.

Then, the European Commission told the City of London that a proposal to allow British banks basically the same rights as EU banks across the EU would not be accepted. Added to these issues is a leaked Government report that states that no matter what deal the UK gets on trade, its economy will slump by up to 8% following Brexit.

So far, the pound has managed to retain its New Year rally versus the dollar and Euro closing yesterday at 1.4198 and 1.1437, which was in both cases, close to the high of the day.

Considering your next transfer? Log in to compare live quotes today.

Powell takes over from Yellen at Federal Reserve

Gains in employment, household spending, business fixed investment have been solid; near-term risks to the economy appear “roughly balanced”. This led traders to believe that the Fed remains on track to hike rates again in March, a prospect that has 60% certainty according to interest rate futures markets. The statement also confirmed the previous language regarding the gradual nature of rate increases.

The dollar index remains mired near its recent lows unable to shake off the Treasury Secretary’s comments last week about a weaker dollar being in the best interests of the country in the short term.

Powell was unanimously accepted as Fed. Chairman by the committee and will take over officially on February 5 when he will make his first speech.

Eurozone inflation defies calls for tighter monetary policy

Inflation across the Eurozone rose by 1.3% in the year to December down from 1.4% in November with core inflation down to 1% from 1.1%. This allayed any calls for a pre-emptive tightening of monetary policy despite Bundesbank models predicting “significantly” higher inflation later in the year.

The single currency rose to a high of 1.2475 yesterday, again approaching its medium target of 1.2520 but fell back on profit taking closing at 1.2415. The short-term path for the Euro will be determined by the dollar although as the Italian election campaign “hots up”, politics could start to play a role.

Have a great day!

About Alan Hill

Alan has been involved in the FX market for more than 25 years and brings a wealth of experience to his content. His knowledge has been gained while trading through some of the most volatile periods of recent history. His commentary relies on an understanding of past events and how they will affect future market performance.”